Getting in on The Act: How Will Central Bank Digital Currencies Change the Way We Make International Payments?

Posted on the 24th May 2024 by Hamish Anderson in Founders' blog, Business, Finance

For a few years now the central banks have observed the rise of cryptocurrencies and other digital assets like NFTs (non-fungible tokens) and stablecoins. Much has been written about digital assets and Central Bank Digital Currencies (CBDCs) are at the forefront of a revolution which is poised to reshape foreign exchange markets and alter the financial operations of UK-based SMEs and international payments users.

Continue readingNavigating the Waves: FX Risk Management for Small Businesses

Posted on the 19th April 2024 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

In an era where macroeconomic uncertainties seem to be the only constant, businesses venturing into the global marketplace face a multitude of challenges, not the least of which is managing foreign exchange (FX) risk. However, fear not! By adopting strategic FX risk management practices, businesses can shield their bottom lines from adverse movements and turn a potential threat into a competitive advantage. In this month’s blog, we explore some strategies to master the art of FX risk management.

Continue readingUnraveling the Xero Effect: A Game-Changer for Accountants and Clients in the International Payments Realm

Posted on the 13th March 2024 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

For the UK's fintech sector and its users, the emergence in recent years of accountancy platforms like Xero has been nothing short of revolutionary. As a fintech company focused on navigating the intricacies of making payments across borders, we've witnessed firsthand (and experienced ourselves) the transformative impact Xero has had on our partners in the accountancy sector and their clients. In this blog we will delve into the core of this transformation, exploring how Xero has not just solved problems but has also redefined the financial landscape.

Continue readingRevolutionising the World of Numbers: How Fintech and Digital Tools have Transformed the Accountancy Profession

Posted on the 15th December 2023 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

The days of crunching numbers with a calculator and manually balancing books are fading into the past. Today, fintech and a plethora of digital tools have emerged as the driving force behind the transformation of the accountancy sector. In this blog post, we'll dive into the exciting ways in which fintech businesses like ours, and digital tools, have reshaped the world of accountancy.

Continue readingBank of England's Interest Rate Decision and Its Currency Market Impact

Posted on the 2nd November 2023 by Hamish Anderson in Founders' blog, General news, News, Business, Finance, Founder Insights

In today's global economy, the decisions made by central banks can have an impact on businesses worldwide. One such decision was made today by the Bank of England when it chose to hold interest rates steady at 5.25%. In this blog post, we will contemplate the Bank of England's decision, its influence on currency markets, and why businesses should pay close attention.

In today's global economy, the decisions made by central banks can have an impact on businesses worldwide. One such decision was made today by the Bank of England when it chose to hold interest rates steady at 5.25%. In this blog post, we will contemplate the Bank of England's decision, its influence on currency markets, and why businesses should pay close attention.

Navigating the Currency Landscape: What Scale-Up Businesses Need to Know

Posted on the 26th October 2023 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

Navigating the intricate global currency landscape is key for fostering growth and ensuring the success of your business. In this post, we will dive deeper into the essentials that scale-up businesses must grasp when it comes to currency management.

Continue readingThe Vital Connection: Paying Suppliers and Global Commerce

Posted on the 12th October 2023 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

UK businesses today are, by default, global. Regardless of sector, they operate in a fully interconnected world, compete with international companies, and must reach across borders to find customers, partners, and suppliers.

In order for all of this to function though, money must always be able to move across borders smoothly, reliably and at low cost.

Continue readingFintech Fights Fraud

Posted on the 21st September 2023 by Hamish Anderson in SME blog, Business, Founders' blog, Founder Insights

In the ever-evolving world of international payments, staying ahead of the curve means embracing innovation. However, as quickly as exciting new financial instruments and technologies emerge, so too do new challenges. One of the foremost concerns today is the heightened risk of fraud accompanying these cutting-edge tools. In this blog post, we'll delve into the world of these novel instruments, the real concerns they pose, and how fintech companies like Money Mover are tackling fraud head-on.

In the ever-evolving world of international payments, staying ahead of the curve means embracing innovation. However, as quickly as exciting new financial instruments and technologies emerge, so too do new challenges. One of the foremost concerns today is the heightened risk of fraud accompanying these cutting-edge tools. In this blog post, we'll delve into the world of these novel instruments, the real concerns they pose, and how fintech companies like Money Mover are tackling fraud head-on.

The Future of Cross-Border Payments: Bank of England Predicts a Monumental Surge

Posted on the 29th August 2023 by Hamish Anderson in SME blog, Business, Founders' blog, General news, Founder Insights

In the rapidly evolving landscape of international finance, the dynamics of cross-border payments play a pivotal role. As technology continues to redefine our world, the financial sector is no exception. The Bank of England's recent prediction of a significant increase in the value of cross-border payments from $150 trillion in 2017 to over $250 trillion in 2027 is not just a statistic; it's a testament to the power of innovation and global connectivity.

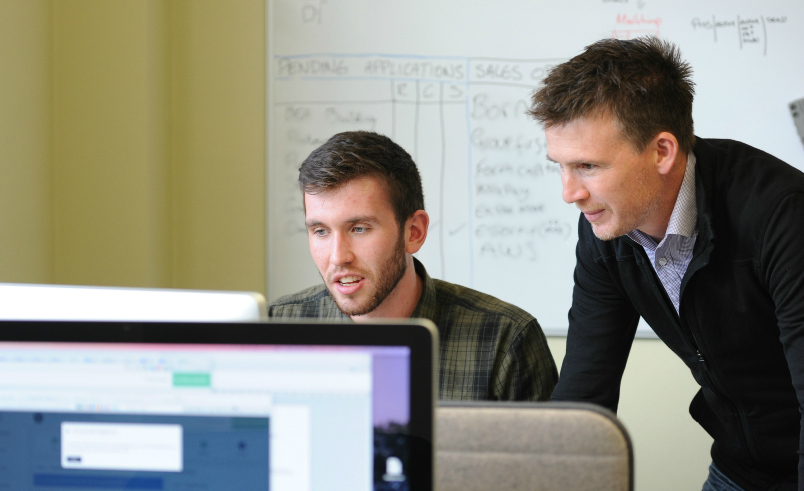

Continue readingReflecting on a Decade of Fintech Transformation

Posted on the 18th July 2023 by Hamish Anderson in Founders' blog, Business, Finance, Founder Insights

Last week I wrote about Money Mover’s journey over the last decade. At the time of founding the business, I was working at HSBC and it’s fair to say that the financial sector looked vastly different ten years ago.

Looking back, I am amazed by the rapid evolution and revolutionary changes we have witnessed in the fintech landscape in recent years.

Continue readingFrom Startup Struggles to Success: A Fintech Founder's Guide to Surviving 10 Years in the Industry

Posted on the 27th June 2023 by Hamish Anderson in Business, Founders' blog, Founder Insights

When Money Mover was born 10 years ago, the fintech industry was a vastly different place. Andrew, Simon and I dreamed of creating a business that would leverage the latest technology to improve the way that businesses made international payments. While we may not have achieved mythical unicorn status, our journey through the ever-changing fintech landscape has been a testament to resilience, determination, and a steadfast vision. As we celebrate our tenth year, we reflect on the invaluable lessons we've learned to survive and thrive in the tumultuous world of fintech.

Continue readingWhen Banks Go Bad

Posted on the 17th March 2023 by Hamish Anderson in Business, Founders' blog, Founder Insights

A week ago today, the first stories of big trouble at Silicon Valley Bank (SVB) were hitting the newsdesks. As befits the zeitgeist, rumours spread by social media of balance sheet inadequacies at America's 17th largest bank led to a rush to withdraw deposits and falling share prices. Would the issues affecting a specific institution lead to market contagion and put other banks at risk? Bankers and entrepreneurs went into the weekend with trepidation and concern.

Continue readingExploring the Impact of AI on International Payments

Posted on the 17th February 2023 by Hamish Anderson in Business, Founders' blog, Founder Insights

Interest in artificial intelligence (AI) has stepped up a notch in the last few months as ChatGPT has burst onto the scene. The natural language processing tool created by OpenAI has done what flying cars and hoverboards haven’t (yet). It’s here, it’s usable, and it’s poised to replace a large portion of the workforce. So I decided to take a look at how AI has already become an integral part of the global financial system and what the future holds. As the world becomes increasingly connected, the impact of AI on making international payments, managing fraud, and detecting money laundering will be significant.

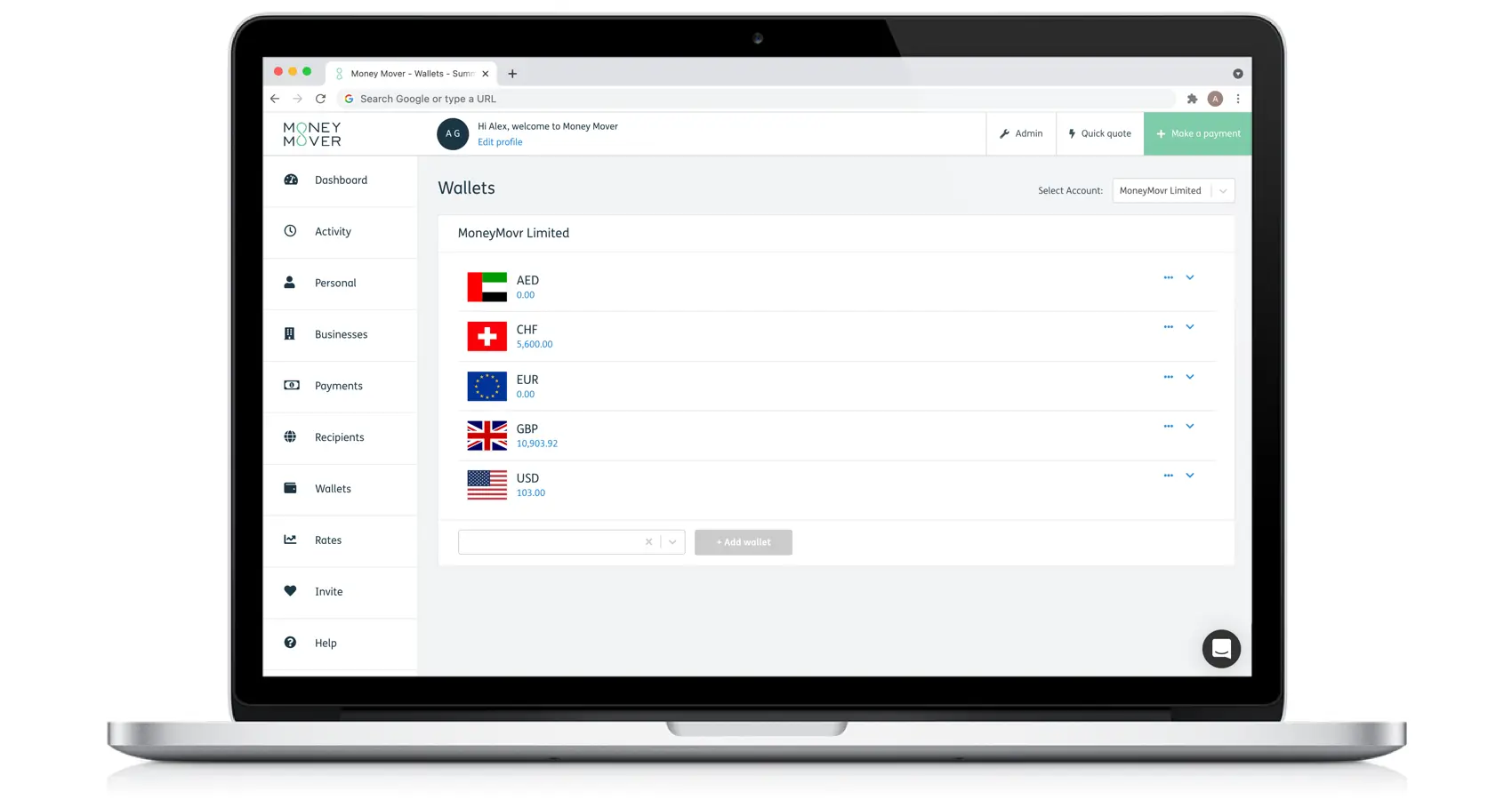

Continue readingMoney Mover launches multi-currency wallets

Posted on the 28th September 2021 by Alex Garbutt in News, Business, Finance, Money Mover News, General news

Running foreign currency bank accounts is often expensive, complicated and time-consuming, but there is an easier way. Money Mover’s multi-currency wallets give you and your business access to virtual accounts in 25+ currencies, all fully integrated within Money Mover’s cloud-based platform. Receive funds with your own IBAN, BIC/SWIFT, account number and sort code, hold funds in currency wallets, convert at bank-beating exchange rates and make payments to over 200 countries around the world.

Continue readingFilling in the gaps

Posted on the 21st May 2021 by Hamish Anderson in Founders' blog, SME blog, Business, Finance

In his latest blog, Hamish takes a look at the recent explosion in digital banking services, which is a good thing, and how the majority ignore the needs of international businesses, which is a bad thing.

Fortunately, there is a solution, and it's not even necessary to abandon your funky anodised debit card!

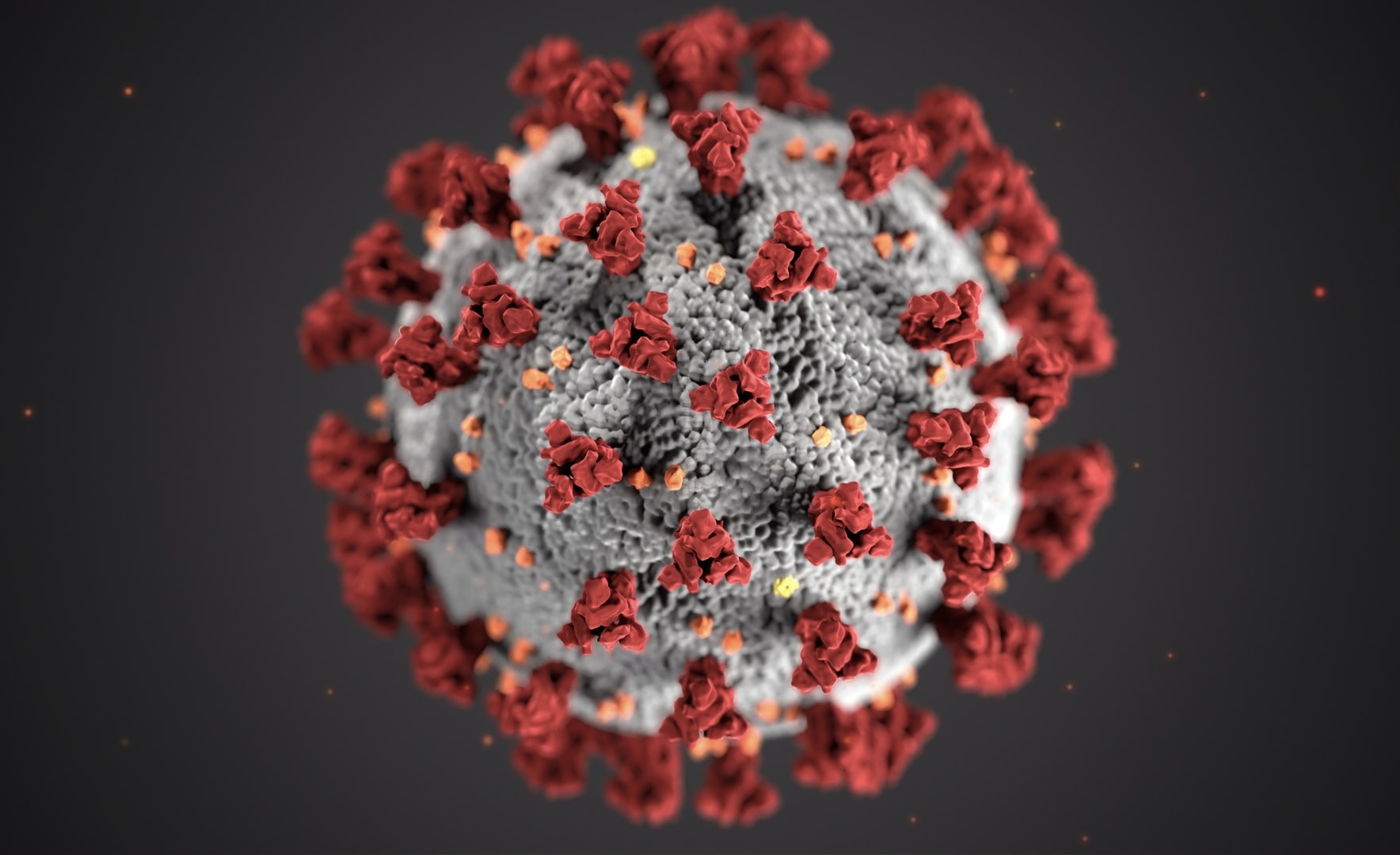

Continue readingFour months of CBILS – what we’ve learned so far

Posted on the 30th July 2020 by Faye McDonough in SME blog, Business, Finance

It seems a lifetime ago, but it is actually only a few months since the Coronavirus Business Interruption Loan Scheme (CBILS) was announced by the Chancellor as part of a series of government measures to support the UK’s small and medium-sized businesses during the Covid-19 pandemic.

In this month's guest blog, Faye McDonough, Principal at BOOST&Co, recounts her story of the past four months, from the viewpoint of an entrepreneurial business and an independent lender.

Continue readingNotes on a virus

Posted on the 30th June 2020 by Hamish Anderson in Founders' blog, Business, Finance

The impact of Covid-19 on Money Mover users

I thought it would be interesting to take a look at the changes in activity that we’ve observed amongst our SME (small and medium-sized enterprise) users over the last few months pre- and post-lockdown. While different countries acted at different times, lockdown in the UK started on 23 March 2020.

As Money Mover is still very much in a growth phase, we expect to add users, increase our volume and number of payments every month. Therefore our reference points are the prior month and the same month in previous years.

Continue readingMaking Sense of the Metro Bank Remedies Bungle

Posted on the 29th February 2020 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

Do you recall the controversy surrounding the £120m award to Metro Bank from the RBS Capability & Innovation Fund almost exactly a year ago? Eyebrows were raised at the time for several reasons. Firstly, observers and other participants in the process struggled to grasp how committing to opening additional bank branches in the north of England qualified as "developing more advanced business current account offerings", however worthy the intention. Secondly, throwing £120m at an institution which, days before, had owned up to a £900m hole in its balance sheet, had the most open-minded amongst us scratching our heads.

Continue readingWhy banks treat alternatives managers as second-class citizens

Posted on the 20th November 2019 by Hamish Anderson in Founders' blog, SME blog, Business, Finance, Founder Insights

Money Mover has now been an AIMA (Alternative Investment Management Association) partner for just over a year. I was chatting to delegates at its recent Spotlight on Raising Assets event in London and it occurred to me that I hadn’t ever explained why this partnership is so important to us and what we think it brings asset managers.

Continue readingIf you're not paying for it, you're the product

Posted on the 11th October 2018 by Hamish Anderson in Business, Founders' blog, Founder Insights

There is a growing number of international payments services out there, and new ones spring up all the time. It’s always been important to us that people understand why Money Mover couldn’t be more different from old school foreign exchange businesses with their boiler room sales people and low-tech service.

For us, transparency is all, and we’re committed to being honest about how we charge for our services, rather than subsidising costs with revenues generated from advertising, referral fees and cross-selling. Above all, we are vehemently opposed to monetising our customers’ financial records and transaction history.

Continue readingOpen Banking - what is it, and why do I care?

Posted on the 26th April 2018 by Hamish Anderson in Founders' blog, Business, Finance

By now you’ve probably heard about open banking. You may have even received a cryptic letter from your bank, asking for permission to do all sorts of things, and are wondering what all the fuss is about.

What is Open Banking?

As Money Mover users and supporters, you’ll probably agree with me that banking has been dominated by a small number of large players for too long.

Open banking seeks to change this by making it easier for to work with other banks and financial institutions, whether it’s to switch accounts or access new products and services.

The point of all this is to encourage innovation and improve competition in the financial sector.

Continue readingDaylight Savings? Or is your current provider committing daylight robbery?

Posted on the 27th March 2018 by Giles Hutson, CEO of Insignis Cash Management in SME blog, Business, Finance

Whether saving for a rainy day, a future business purchase or an inevitable tax bill; businesses and individuals can earn better interest on their cash reserves.

Money Mover invited Giles Hutson, the co-founder and Chief Executive of fellow Cambridge FinTech, Insignis Cash Management to talk about how to generate better returns from excess cash.

Continue readingDeeds Not Words

Posted on the 26th February 2018 by Amanda Nunn in Team blog, SME blog, Business, Finance

The 6th February 2018 marked 100 years since the Representation of People Act - a watershed moment in history, which allowed women in the UK to vote for the first time.

Amanda Nunn, Money Mover's Partnerships Manager, asks how much has changed in the way of gender equality since then, and whether innovative businesses will be instrumental in leading the way for gender equality in the work place.

Continue readingDavid and Goliath - an underdog story

Posted on the 31st January 2018 by Amanda Nunn in Team blog, SME blog, Business

For some 3,000 years, the story of David and Goliath has filled our cultural consciousness. Whatever your literature or film genre of choice, it's likely that somewhere amongst the books you've read or films you've watched, you've come across an underdog story.

Continue readingWhy cryptocurrencies don’t add up for Money Mover and its customers

Posted on the 3rd October 2017 by Hamish Anderson in Founders' blog, Business, Finance, Founder Insights

I’ve just returned from a UK FinTech Trade Mission to Japan which coincided with the Tokyo FinTech Summit (Fin/Sum Tokyo).

A topic which came up frequently in formal presentations, panel sessions and discussions with delegates, was cryptocurrencies. No doubt this was because of the news that Japanese banks are setting up their own digital currency - J-Coin. Indeed, one Japanese FSA employee I chatted with was just about to head off to California on a mission to absorb all things cryptocurrency.

I had the chance to consider my position and thoughts on cryptocurrencies, particularly with regards to our business at Money Mover, and I thought I’d share these with you.

Continue readingOne price on the shelf and another at the checkout…

Posted on the 29th August 2017 by Alex Garbutt in Team blog, SME blog, Business, Finance

The Financial Conduct Authority (FCA) is cracking down on Payments and e-Money Institutions that are using currency conversion tools in a “potentially misleading” way.

Continue readingWhat makes Money Mover different?

Posted on the 21st August 2017 in SME blog, Business, Founders' blog, Founder Insights

There are a lot of international payments services out there and it’s important to us that people understand why Money Mover couldn’t be more different from old school foreign exchange businesses with their boiler room sales people and low-tech service.

Continue readingThe Dangers for Sterling of Rolling the Dice

Posted on the 9th June 2017 by Hamish Anderson in SME blog, Business, Founders' blog, Founder Insights

As the exit polls predicted that the UK was on course for a hung Parliament, the pound dropped almost 2% against the US Dollar and the Euro in a matter of seconds.

Continue readingLeading the world in financial innovation

Posted on the 11th April 2017 by Dorianne Sager in Business, Finance, Money Mover News

The UK is the world’s leading FinTech hub, generating more than £6.6 billion revenue and employing over 61,000 people. To support this growing sector and cement Britain’s position as the global FinTech capital, the UK government is hosting a new, annual FinTech conference on April 12th to showcase the country’s FinTech talent.

Continue readingThe effect of Brexit on international payments and transfers - managing currency risk

Posted on the 16th February 2017 in Business, Finance

As the shock of last June’s vote to leave the European Union slowly wears off, the reality of a post-Brexit Britain is starting to emerge. The pound dropped to its lowest value in 31 years directly after the referendum and is currently hovering around £1.22 to the dollar. Once Article 50 is triggered sometime in March, official divorce proceedings will begin. Like any divorce, ending the relationship between Britain and the EU is guaranteed to be an emotional and drawn out negotiation. During this time, the one currency everyone will be trading in is uncertainty.

Continue reading