Notes on a virus

Posted on the 30th June 2020 by Hamish Anderson in Founders' blog, Business, Finance

The impact of Covid-19 on Money Mover users

I thought it would be interesting to take a look at the changes in activity that we’ve observed amongst our SME (small and medium-sized enterprise) users over the last few months pre- and post-lockdown. While different countries acted at different times, lockdown in the UK started on 23 March 2020.

As Money Mover is still very much in a growth phase, we expect to add users, increase our volume and number of payments every month. Therefore our reference points are the prior month and the same month in previous years.

December and January: the lull before the storm

After a busy December in which we saw year-end book balancing activity in addition to regular monthly payment flows, January calmed down considerably. While payment numbers were up, our average transaction size was roughly half that of December. Traffic on our website was up about 5% and it was our second busiest month ever for activating new users.

February: exchange rate volatility rises

February started strongly as average transaction sizes increased, pushing overall volumes of currency traded up by 50% compared with the previous month. As news broke of the spread of Covid-19 around the world, and each country’s response to it, we began to see exchange rate volatility rise. Usage of our ‘Exchange Rate Alerts’ functionality increased as the month went on and users started to track the progress of currency pairs which were most relevant to them.

March: GBP weakens and encourages buyers

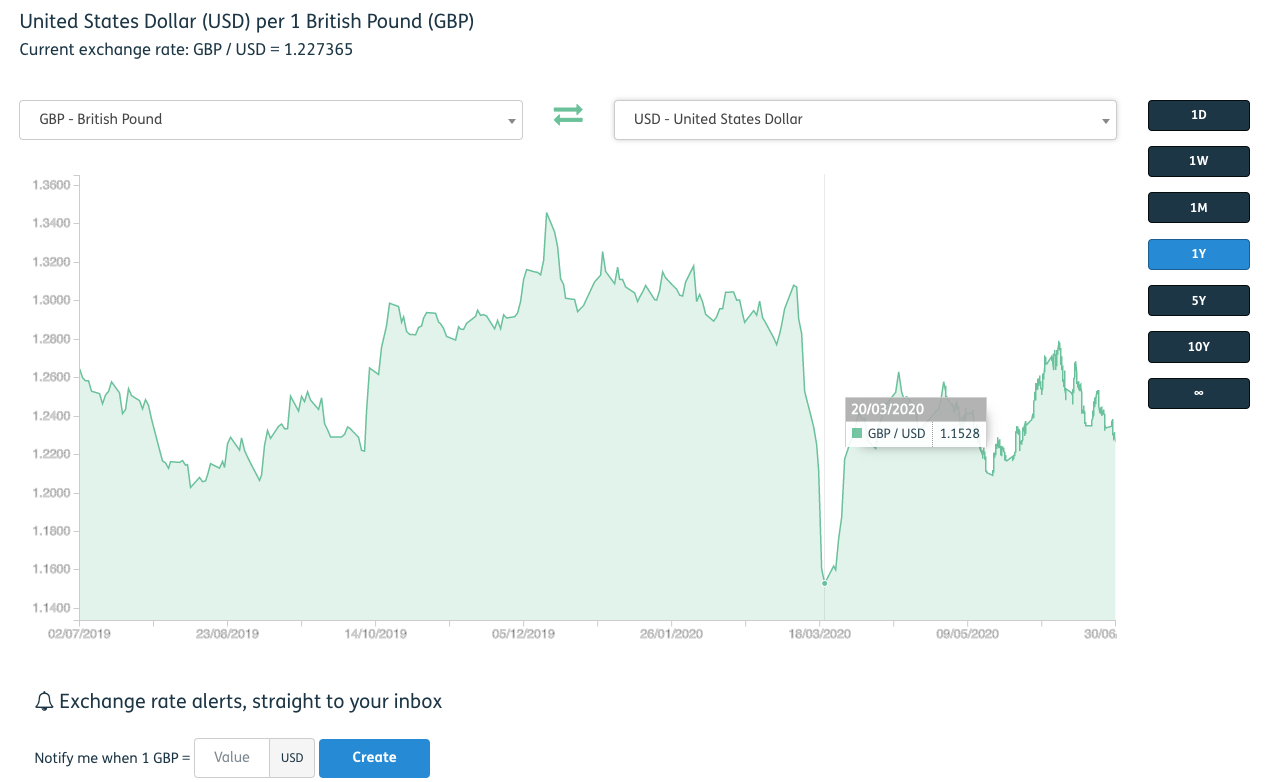

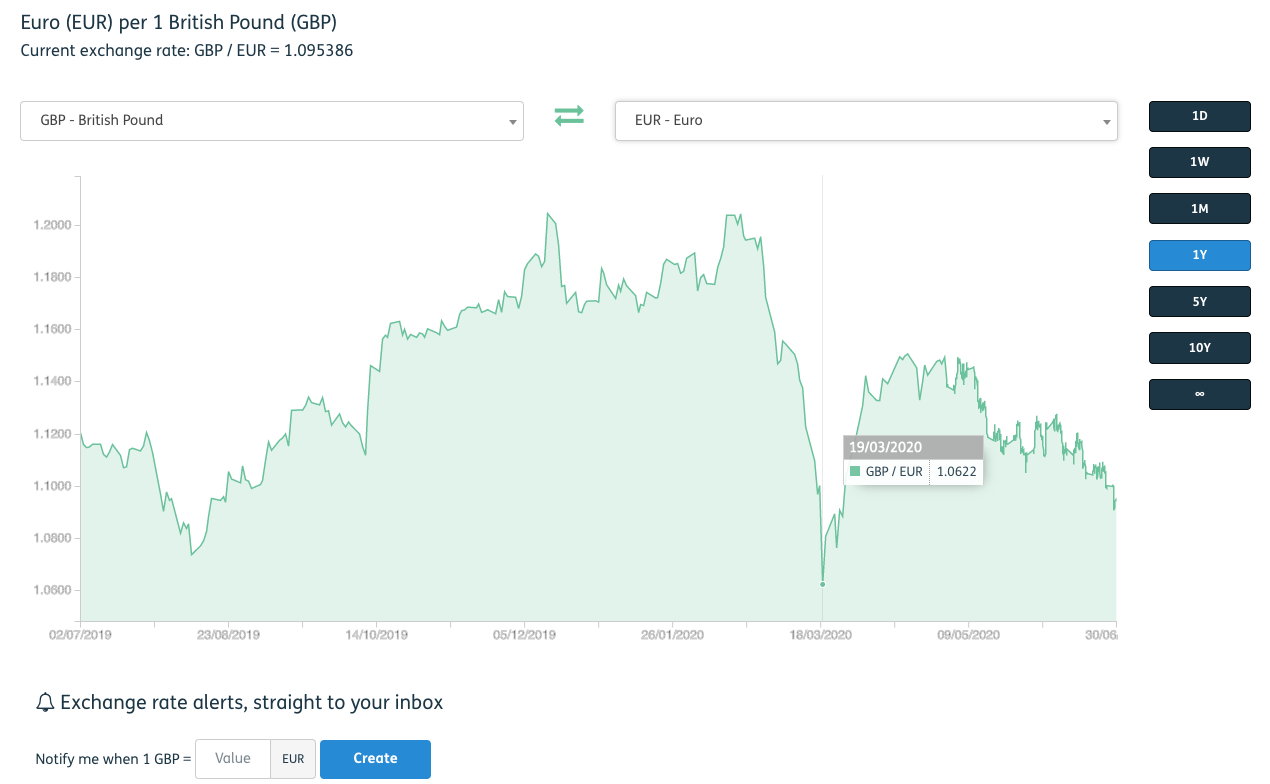

As we moved into March and countries began to announce lockdowns, confidence in GBP faltered. Sterling struggled to hold its ground at 1.30 against the USD and 1.20 against the EUR and finally gave up the fight during the week of 9 March.

Within days it had fallen to 1.15 against the USD and 1.06 against the EUR (see figures 1 and 2). While this decline was unwelcome news for those needing to sell GBP to fund payments in other currencies, it led to an unexpected windfall for holders of USD and EUR.

We saw several users who were holding USD proceeds from recent investment rounds, or who had built up EUR war chests, purchase GBP at this point and receive 10% more than they had expected. Such activity more than doubled our volumes in March and gave us our busiest ever transactional month.

April and May: lockdown takes effect

The story in April and May could not have been more different. Transactional numbers faltered in April and the overall volume of currency across the platform reduced, seeing a return to the levels of the previous year. We took on fewer new users and we saw only a small increase in web traffic over the period. Anecdotal evidence from users and fellow fintechs suggested that activity had declined by up to 50% in March as many organisations simply shut their doors and hung on to cash.

As lockdown took hold, the toll of the dead and infected rose and the economic outlook deteriorated. Activity from our users in the hospitality and travel sectors fell to almost nothing and expenditure on overseas payrolls declined. If there was some good news, the entire Money Mover team had started working remotely and had maintained our service at normal levels.

June: increased activity

While it’s far too early even to suggest a return to normality, and we have doubtless only just started to experience the impact on the global economy, June shows tentative signs of recovery. Transactional volumes are starting to recover and we’ve carried out more payments in a single month than ever before. Web traffic is also increasing at pre-lockdown rates.

Finding a way forward

There are so many unknowns. When will the second Covid-19 spike occur and how will the economy cope with another period of lockdown? How severe and permanent is the damage that has already been caused to the economy? Will activity levels have recovered sufficiently by the autumn for workers leaving furlough to re-activated by their employers, or will many simply move to the growing ranks of the unemployed.

Our ability to recover from this unprecedented period will depend on many factors - our success in balancing the needs of public health with economic expediency; our ability to test, trace and isolate effectively; and to learn how to live alongside the virus, with or without a vaccine.