Money Mover partners with NatWest to deliver SME pilot

Introduction

In April 2016, while attending the Innovate Finance Global Summit in London, Hamish Anderson, CEO of Money Mover, was set a challenge by one of the world’s most highly regarded strategy consultancies. Could Money Mover make its innovative international payments proposition for SMEs fit for purpose for one of the UK’s major banks?

In what became a competitive pitch to NatWest the answer was a resounding ‘yes’.

The challenge

As with most big banks, NatWest’s larger commercial and institutional customers are well catered for, having access to a variety of banking platforms for international payments, including Bankline, FX Micropay and Agile FX. However, NatWest wanted to improve the experience for SMEs and offer them a customer-focused, seamless, easy to use international payments system offering exceptional transparency, functionality and reporting.

The solution

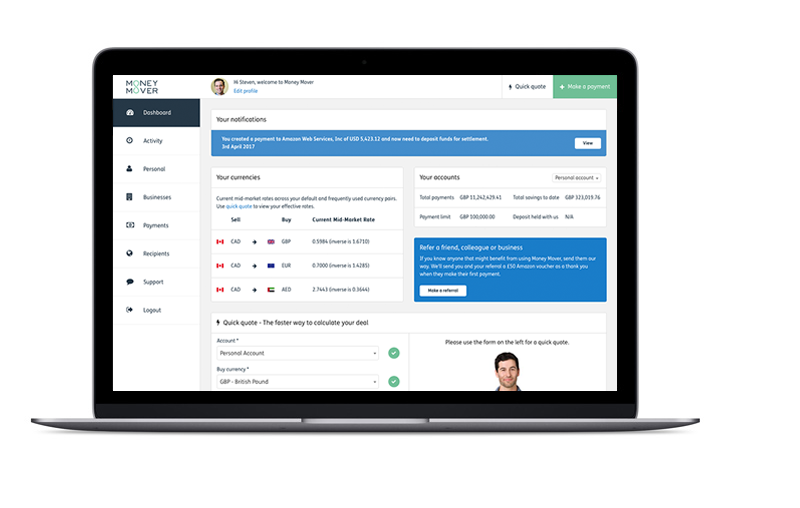

By July 2016, a plan was in place and, working with the NatWest Innovation Team, a pilot programme was established to offer NatWest’s London and South East’s SME customers a new user interface for international payments. For the purposes of the prototype, Money Mover was tasked to create a ‘white labelled’ service, powered by Money Mover but under the auspices of NatWest. While the aim of the pilot was to obtain feedback from its customers on the radically different user interface and process flow provided by Money Mover, NatWest, understandably, was not prepared to compromise on its high standards of security, compliance, reliability, speed and service.

Conclusion

The NatWest Relationship Managers reflected that taking the pilot to their customers not only gave them something exciting to talk about but underlined the bank’s commitment to innovate.

For Money Mover, selection for the pilot confirmed that its carefully crafted UI and UX were class-leading. It also demonstrated it could operate at the level required to work strategically with one of the world’s largest banks to become a trusted and secure provider.

Provide Money Mover's class-leading front end to your customers

Plug & play international payments UI/UX and technology

Discovery

Service specification, integration points, compliance & security, design and branding

Implementation

Prototype, data migration, customisation and enhancements, systems integration, training

Quality assurance

System testing, quality audit, prototype feedback, sign-off by client

Launch

Deploy production environment, migrate customers, import production data, project handover

We were delighted to be chosen as NatWest’s partner for this important project. We have always been confident that our platform and customer proposition is a game changer for SMEs. But this pilot has proved that we can operate at the highest level, and most importantly, that our technology, security, service and user experience is class-leading and ready to be deployed by other financial institutions.

Hamish Anderson, CEO of Money Mover

Money Mover Services

Transforming international payments

Money Mover Software

Money Mover Software

Money Mover's Software service is designed for financial institutions looking for a fast and cost-effective way to upgrade their international payments front end and technology stack.

Software provides your customers with access to all of the Money Mover international payment tools and reporting. including all of the administrative functionality for onboarding and operations staff. Software integrates with your existing payments architecture, compliance, transaction monitoring and pricing systems.

Other services

Money Mover Transact

Transact is Money Mover's standalone international payments service. Specially designed for small to medium sized businesses (SMEs) that need a low-cost, transparent and easy use international payments service.

Money Mover Integrate

Integrate is designed for businesses and organisations that would like to provide international payments functionality to their customers within their own infrastructure or software platforms.