Forwards and hedging

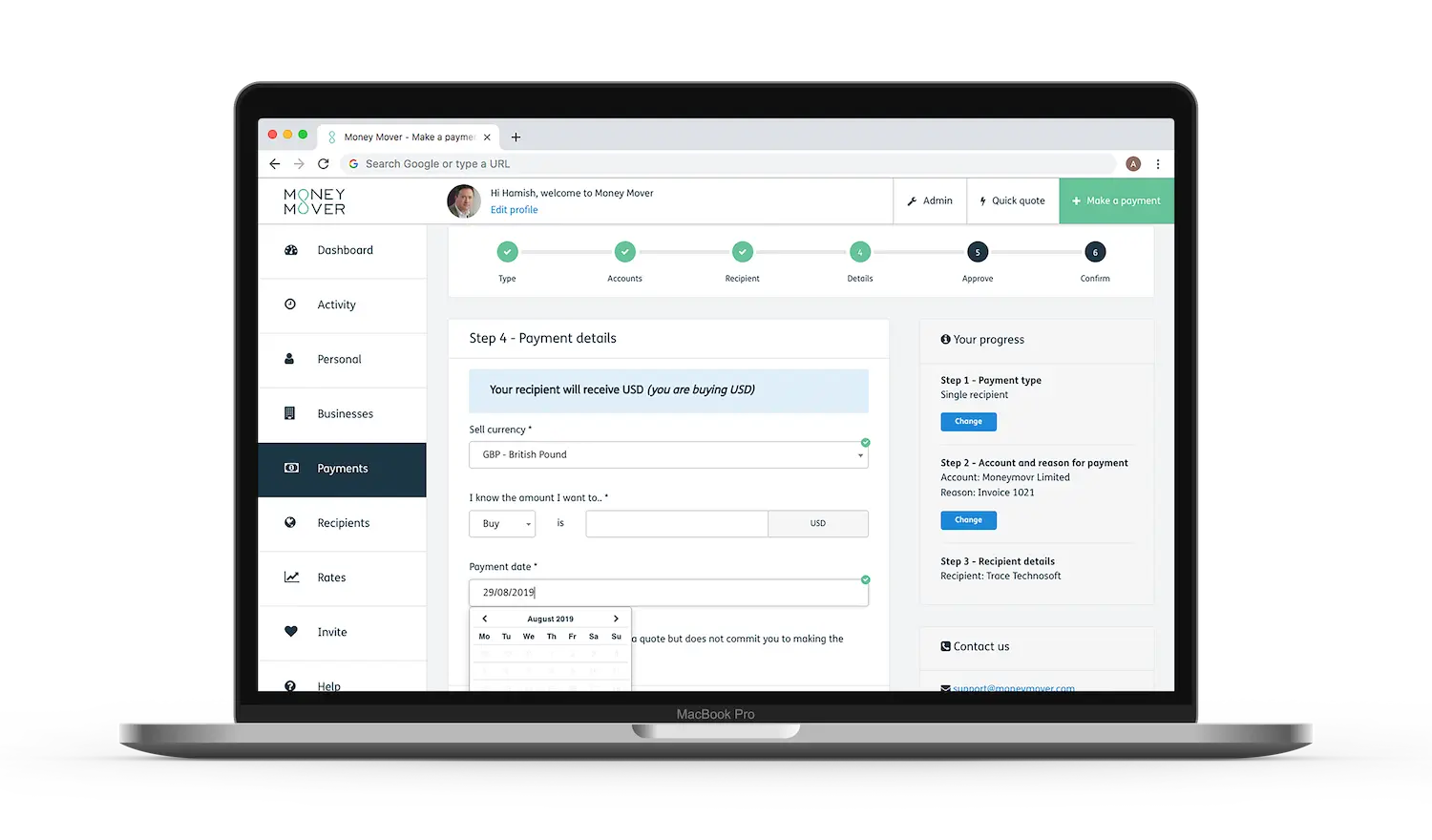

Our Flexible Payments calendar allows you to choose when you want your payment to be sent to your recipient.

Speed up payments

Need to make a payment urgently? Ensure your payment reaches to your recipient promptly via SWIFT GPI or local payments.

Lock in an exchange rate

By selecting a date in the future, you can lock in an exchange rate for an invoice or receivable of a known amount at a future date.

We put you in control

Simply select your preferred payment date using our Flexible Payments calendar.