The hidden cost of moving money internationally

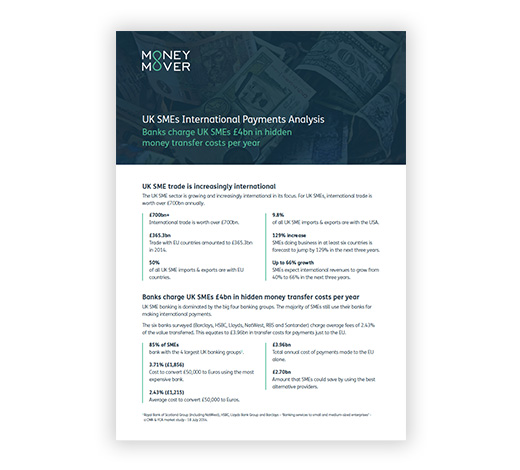

UK SMEs (Small and medium-sized enterprises) made £700 billion of international payments in 2014. Around 90% of these payments were made via internet banking with their clearing banks. Our report shows that this has cost UK SMEs billions of pounds more in bank charges than it should have done - a tax on international trade that just can't continue.

Why we created this report...

Find out how much your business is being overcharged by using your bank

To get more from your transfers, you need more from your provider

It's not all about the cost, but it's a good place to start. Why pay five times more than you need to when you pay a supplier or transfer money to your overseas office to make your payroll? You can make a significant saving for your business by changing the way you make your international payments and transfers.

Money Mover can provide a transparent, low cost and secure alternative, built to suit the way your business operates.

How much are you being overcharged by using your bank?

By analysing the international payments service offered by each bank, we've calculated how much they are charging their customers in hidden money transfer fees. Using this information we've put together this interactive slider so you can find out how much you could save by using Money Mover instead of your bank.

Who do you currently bank with?

You could save

£

on your global payments every year by using

a provider like Money Mover

How is this calculated?

We've calculated the overcharge figure by comparing the bank costs, identified by Accourt, with the cost of using Money Mover for the same international payment.

Share with your network

Spread the word and make sure that your network understands the real cost of international payments.

See the facts for yourself.

Download the independent report

It's time to dispel the myths once and for all. This Summer, we commissioned Accourt, a specialist payments industry consultancy, to find out the truth about the costs of international payment. They put the UK's leading business bankers to the test and have published their findings.