CMA report response and analysis

Posted on the 23rd October 2015 by Alex Garbutt in SME blog

This week the Competition and Markets Authority (CMA) released its long-awaited retail banking report. So what did they have to say? Surely after 18 months of research they would be announcing something fairly significant? Well… not really. It seemed a bit… soft, for want of a better word.

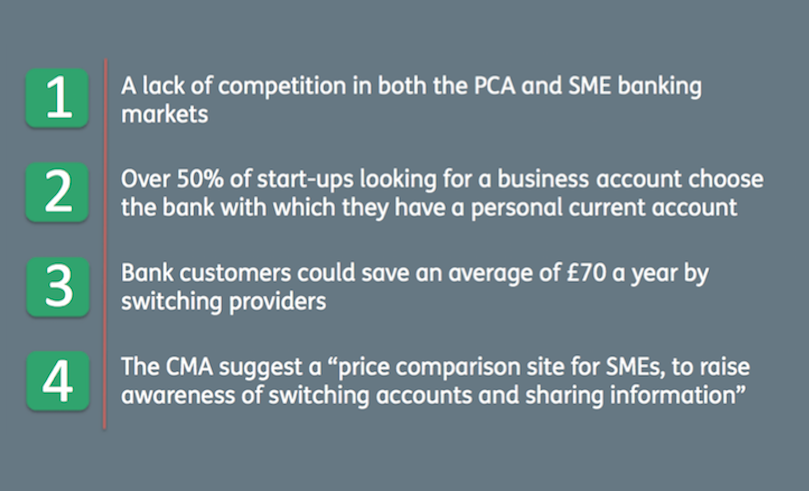

Key talking points

- The report found competition problems in both the provision of PCAs (Personal Current Accounts) and SME banking

- 57% of consumers have stayed with the same bank for over 10 years

- Bank customers could save an average of £70 a year by switching providers

- The CMA suggest a “price comparison website for SMEs, to raise awareness of switching accounts and sharing information”

If you weren’t exactly taken aback by these findings then you’re not alone. It’s hardly revolutionary.

Virgin Money chief executive Jayne-Anne Gadhia came out and said that the findings “do not go far enough”. Thoughts were echoed by executive director of consumer body Which?, who expressed his disappointment by stating that the “proposals don’t go far enough”.

I find myself of the same opinion. It’s all well and good spending a year and a half looking into the issues in the banking sector, but they’re issues that a lot of the public are already aware of and I, for one, was expecting something slightly more substantial. It seems like the CMA is playing on the cautious side and their report seems a bit timid.

There is lots of talk about implementing more regulation to improve the situation for SMEs: more monitoring, charging banks interest on current account credit balances and pushing for more transparency. Don’t get me wrong, these sound like great suggestions, but regulation is often painstakingly slow and, putting my economist's hat on briefly, inefficient!

Competition is coming from outside the banking sector

Fortunately, it looks like revolution is coming from the ground up. The banking landscape is being changed more quickly by the masses than ever it would be by the regulator. Disruption is a buzzword at the moment and nowhere more so than in the financial sector. Financial Technology (FinTech) companies are growing and pulling chunks off almost every aspect of the banking sector; unbundling and refining the individual branches:

- MarketInvoice is reinventing invoice finance

- Funding Circle is making business loans much more accessible

- Simple is offering innovative current account services

- Money Mover is offering a feature-rich and transparent international payments service

Competition is the main driver of efficiency. In offering alternatives to consumers and business, competition will soon follow. As long as these innovators remain transparent, low-cost and, of course, innovative, I believe that by the time the CMA comes to bring change to the market, the people will have beaten them to it.

Am I being too harsh on the CMA? I don’t know, I guess I just expected a bit more. Let me know your thoughts below.

Other articles you might be interested in

- Amanda Nunn: Twelve months at Money Mover

- The world of FinTech; a layman’s review

- Legacy Systems and Legacy Thinking: Fintech and the reinvention of financial services